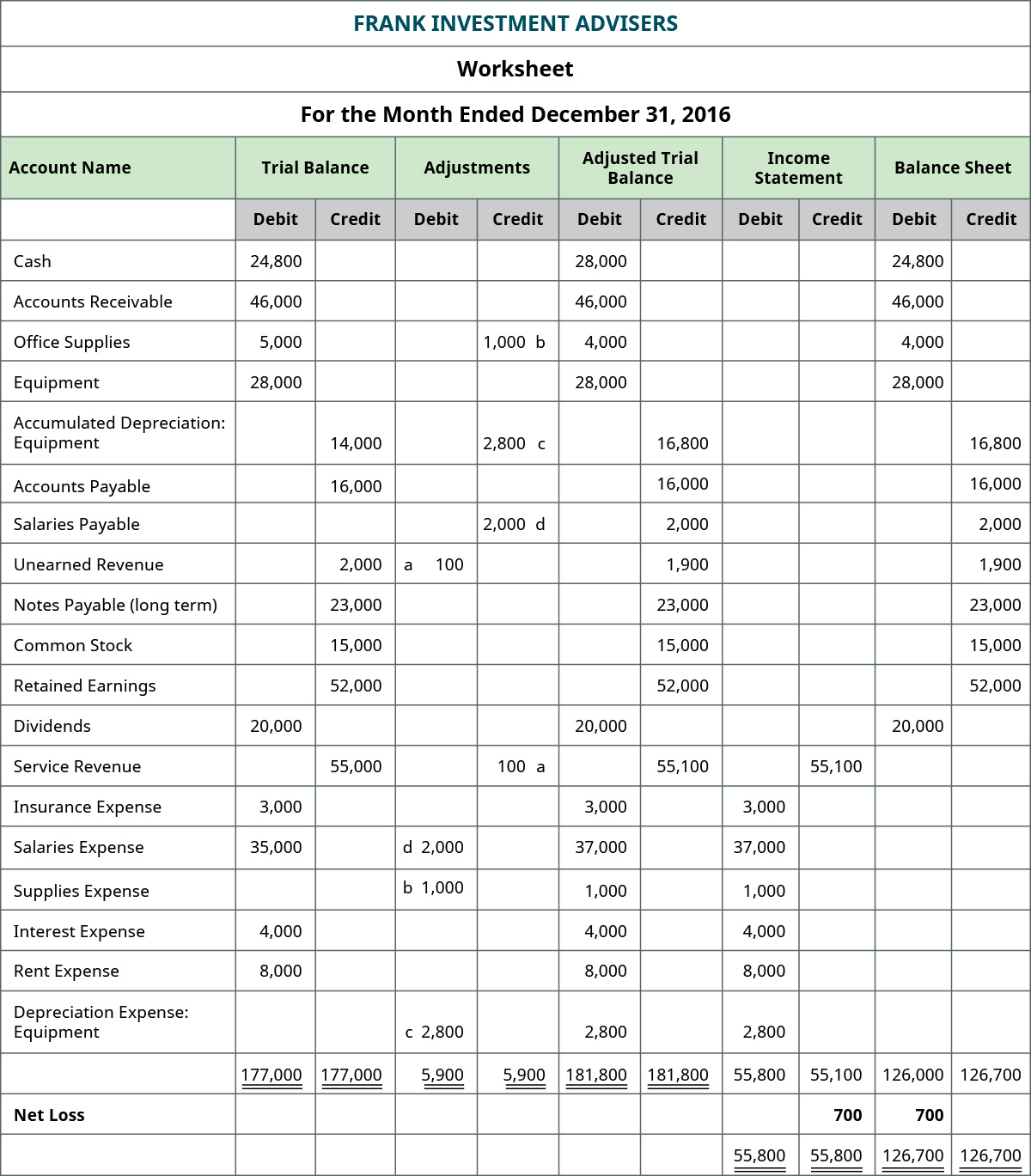

The unadjusted trial balance is the initial report you use to check for errors, and the adjusted trial balance includes adjustments for errors. Both the debit and credit columns are totaled at the bottom and must be equal in order to agree with the accounting equation. If the debits and credits don’t agree, there must have been an error posting the adjusting journal entries.

Unit 4: Completion of the Accounting Cycle

Utilities Expense and Utilities Payable did not have any balance in the unadjusted trial balance. After posting the above entries, they will now appear in the adjusted trial balance. You could also take the unadjusted trial balance and simply add the adjustments to the accounts that have been changed.

Streamline your accounting and save time

The account balances are taken from the T-accounts or ledger accounts and listed on the trial balance. Essentially, you are just repeating this process again top 5 bad accounting habits that could be holding your business back except now the ledger accounts include the year-end adjusting entries. Such types of transactions are deposits, Closing Stocks, depreciation, etc.

Cash or Accrual Basis Accounting?

The adjustments need to be made in the trial balance for the above details. Depreciation is a non-cash expense identified to account for the deterioration of fixed assets to reflect the reduction in useful economic life. As the name suggests, it includes deductions with respect to the tax liabilities. The adjusting entries for the first 11 months of the year 2015 have already been made.

Before preparing the financial statements, an adjusted trial balance is prepared to make sure total debits still equal total credits after adjusting entries have been recorded and posted. An adjusted trial balance lists all account balances after making adjustments. These adjustments account for accrued and deferred items, such as accrued revenues, expenses, and prepaid expenses. The primary goal of an adjusted trial balance is to ensure that all accounts are accurate and that the accounting records are ready for the preparation of financial statements. The first method is similar to the preparation of an unadjusted trial balance. However, this time the ledger accounts are first updated and adjusted for the end-of-period adjusting entries, and then account balances are listed to prepare the adjusted trial balance.

Company

In many ways this is faster for smaller companies because very few accounts will need to be altered. Both ways are useful depending on the site of the company and chart of accounts being used. Notice the middle column lists the balance of the accounts with a debit balance, while the right column has balances for credits. The trial balance is a mathematical proof test to make sure that debits and credits are equal. The salon had previouslyused cash basis accounting to prepare its financial records but nowconsiders switching to an accrual basis method. You have beentasked with determining if this transition is appropriate.

When it comes to the adjustment made, the adjusted trial balance sheet is left with information that is relevant for a particular period as per the information that the business organization seeks. The adjustments made, however, are classified into different categories, which include – deferrals, accruals, missing transactions, and tax adjustments. Marketing Consulting Service Inc. adjusts its ledger accounts at the end of each month.

This balance istransferred to the Interest Receivable account in the debit columnon the adjusted trial balance. AccumulatedDepreciation–Equipment ($75), Salaries Payable ($1,500), UnearnedRevenue ($3,400), Service Revenue ($10,100), and Interest Revenue($140) all have credit final balances in their T-accounts. Thesecredit balances would transfer to the credit column on the adjustedtrial balance. Just like in the unadjusted trial balance, total debits and total credits should be equal. After posting the above entries, the values of some of the items in the unadjusted trial balance will change. However, most businesses can streamline this cycle and skip tedious steps like posting transactions to the general ledger and creating a trial balance.

- The latter are necessary in order to ensure an accurate reflection as well as consistency of business income and expenses.

- For example, Interest Receivable is an adjusted account that hasa final balance of $140 on the debit side.

- Service Revenue will now be $9,850 from the unadjusted balance of $9,550.

- The list and the balances of the company’s accounts are presented after the adjusting journal entries are made at the year-end.

- Such types of transactions are deposits, Closing Stocks, depreciation, etc.

In essence, the adjusted trial balance is a tool that confirms whether the ledger balances are accurate after accounting adjustments. Prepare the adjusted trial balance after the initial trial balance, which includes only the unadjusted balances of all accounts. There are multiple financial statements that are prepared by the businesses at the end of a financial year. Still, they prepare an adjusted trial balance as a ready reference.